The marijuana market has had to move quickly in the last few years, especially considering the growth it’s experienced all across the country. When California legalized adult-use marijuana at the end of 2016, the scramble was on for companies to get their permits in order to capitalize on the moment. Terra Tech Corp (OTC QX: TRTC) received temporary authorization to serve both the adult and the medical markets starting January 2018, and they’ve been busy satisfying the immediate influx in demand.

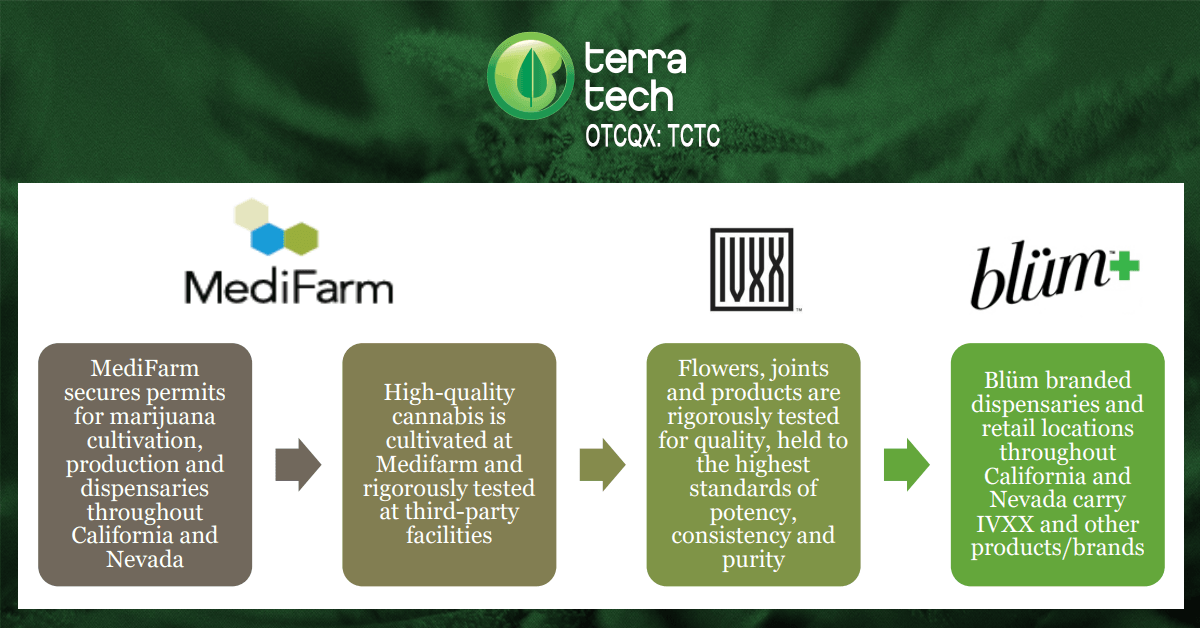

But TRTC also wants to do far more than service patients and customers at its dispensaries and retail outlets in both Northern and Southern California as well as Nevada. They’re hoping to cultivate and grow their own products on their way to achieving full vertical integration. Between lock-up agreements with management, land purchases, and a general reputation for anticipating a diverging market, TRTC is on the verge of making a big splash for customers and investors alike.

First Position

There were very few companies who were able to secure a January 1, 2018 authorization to sell adult-use cannabis, and it put TRTC in a unique position to strike while the iron is hot. California was the very first state to legalize medical marijuana, and they’re expected to become the largest market in the country. This is the time when consumers and patients will be exploring their options and establishing their loyalty. With all the options on the market, they’ll be looking for a dispensary that has quality products, customer service, and a wide selection from which to choose. TRTC manages to check off every box on the list as they ramp up their business to fit the new scale of need. The company has already signed on two craft cultivators of premium cannabis that they believe will drive profits in the right direction. The new plants are not only free of pesticides and chemicals, they also set new standards for potency and purity.

Lock-Up Agreements

TRTC recently saw several of its high-level executives, including the COO, CEO, and CFO, sign lock-up agreements for a full year. These lock-up agreements show investors that the company is dedicated to stability, both in terms of leadership and stock prices. Two directors of the company also signed lock-up agreements, ensuring a unity in long-term strategy. And when the lock-up agreements expire (around the start of 2019), investors likely won’t have to worry about a dreaded stock price drop. The cannabis market is not only growing strong, it’s also poised to launch companies like TRTC into a new realm. CEO Derek Peterson built his career in finance where he became accustomed to exploring and exploiting every new angle to make his company more money. He’s combining that business savvy with a personal mission to bring the healing power of cannabis to an eager audience.

Land Purchases

In October of 2017, TRTC started making moves to purchase property in southern California. This commercial property represents a tremendous opportunity for TRTC to start cultivating their own plants so they can meet their customer’s needs without having to rely on outside suppliers. The key to a successful cannabis enterprise is being able to adapt to each region’s needs without violating any regulations. One dispensary may primarily serve those who are looking for anxiety or depression relief while another may primarily serve those with chronic pain. As the research becomes more definitive and the strains become more specific, TRTC will have the resources to keep up with each new demand.

There is so much happening at TRTC as they lay the groundwork to take the market by storm, but it’s clear the best is still yet to come. Their success lies in their preparation to handle an industry that is still rife with potential pitfalls. Staying profitable isn’t just a matter of staffing a dispensary anymore, but a constant, concentrated effort to keep up with an ever-changing space. TRTC will continue to take proactive measures that keep them ahead of the pack – no matter what it takes.

About the Author

Stuart Smith is the CEO and Founder of SmallCapVoice.com. SmallCapVoice.com. is a recognized corporate investor relations firm, with clients nationwide, known for its ability to help emerging growth companies build a following among retail and institutional investors. SmallCapVoice.com utilizes its stock newsletter to feature its daily stock picks, audio interviews, as well as its clients’ financial news releases. SmallCapVoice.com also offers individual investors all the tools they need to make informed decisions about the stocks they are interested in. Tools like stock charts, stock alerts, and Company Information Sheets can assist with investing in stocks that are traded on the OTC BB and Pink Sheets. To learn more about SmallCapVoice.com and their services, please visit https://www.smallcapvoice.com/the-small-cap-daily-small-cap-newsletter/