5 Reasons Why CULT Food Science, Corp. (OTC: CULTF) Should Be On Your Radar

- Solid Backing: The company’s largest shareholder is Marc Lustig, who sold his last ‘house of brands’ company for $1.1 billion.

- Technical Team: CULT’s CEO Lejjy Gafour is one of the foremost authorities on cellular agriculture in North America, with over a decade of experience.

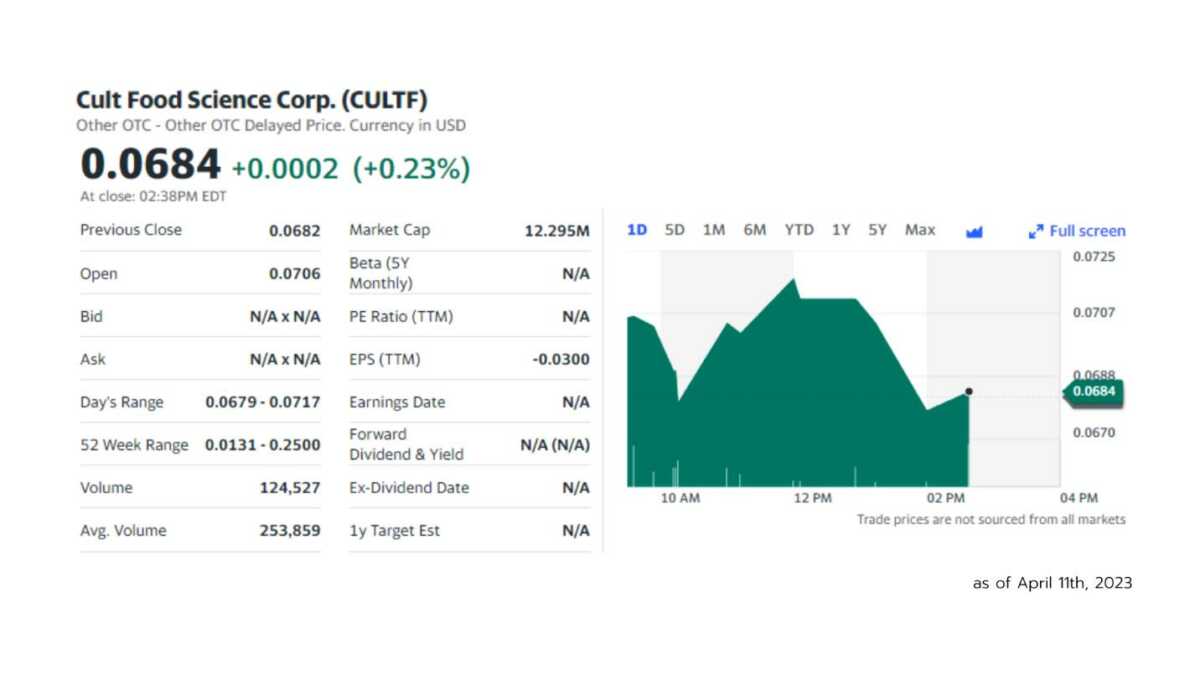

- Recent Performance: The company’s shares are up over 200% year to date, as investors are beginning to discover this sector.

- This is Real Meat: Lab-grown meat is not plant based meat. It is real, genuine animal meat that is made outside of the animal rather than having to farm and slaughter livestock. This is not a ‘replacement product’, it is a ‘replacement process’.

- Pet Food, the First Frontier: CULT is pursuing product development in the pet food space, finally giving pet owners an opportunity to have their pets eat real meat without needing to kill another animal to do so.

Big News Out 4/11/23:

CULT Food Science Announces MOU With JellaTech to Create Collagen Enhanced Pet Foods

Innovative Partnership Enables CULT Food Science to Become One of the First Companies Providing Animal-Free Collagen to Pets

TORONTO, April 11, 2023 /PRNewswire/ – CULT Food Science Corp. (“CULT” or the “Company”) (CSE: CULT) (OTC: CULTF) (FRA: LN0), a pioneer in the investment, development, and commercialization of cellular agriculture technologies and products, is pleased to announce a partnership with JellaTech to launch a line of collagen enhanced pet foods under the Indiana Pets brand created by CULT.

CULTF is Pioneering the $25 Billion Dollar Agricultural Revolution

CULT Food Science (OTC:CULTF) is launching some of the world’s first branded food products that include lab grown meat. CULT is positioned as a first mover in this industry that McKinsey estimates will be worth $25 billion by 2030.

This topic is extremely polarizing, as most progressive shifts in culture and tradition are. Some people love this concept (animal lovers, vegetarians, environmentalists) and some people hate it. Polarization creates opportunity for those with the self awareness to put ego and emotion aside and look at the facts.

For those who aren’t familiar with the topic, lab grown meat is created through a biotech process called cellular agriculture.

As an example, rather than raising a cow for 2 years just to slaughter and butcher it, the meat can be made by taking a cell biopsy from the cow, and then having those cells proliferate in a controlled environment.

The result is the same protein and meat structure, but much quicker, and without the environmental, ethical, and time costs.

The main problem currently is that this process is still more expensive than farming a cow.

But a lot is happening to change this, and bring more capital to the space to scale the production and make the process economically feasible. Many from the industry assume that the costs will follow a pattern similar to Moore’s Law in computing, in which the cost to produce lab grown meat will drop significantly every 2 years.

Here is a short summary on the sector without getting too granular. If you google ‘Lab Grown Meat’ you will find new developments happening nearly every week (just last week a company used DNA from an extinct woolly mammoth to produce a ‘Mammoth Meatball’. The implications of this alone are staggering.

Bill Gates, Richard Branson and Jeff Bezos have all invested in Lab Grown Meat companies.

McKinsey published a research report on the sector, anticipating a $25 billion industry by 2030.

In November 2022, the FDA granted its first safety approval for lab grown chicken.

In March 2023, the FDA granted their second approval for lab grown chicken, further setting the precedent of safety for human consumption.

Lab grown meat has been consumed in Singapore, the only country in the world it is currently regulated for sale, since 2020.

Traditional meat companies Tyson Foods, Cargill, and Archer Daniels Midland have all made investments in cellular agriculture companies.

The benefits of lab grown meat are clear to many large investors

The scaling issue will inevitably be solved, enabling significant revenues.

For investors withoutties to silicon valley or the Asia Pacific foodtech startup scene, options are limited to what is currently available on public markets in North America.

Even though there are over 100 private companies that are well know in the cellular agriculture industry, there are, by our count, only 3 publicly traded companies in North America.

Each company has a unique business model. With that comes unique opportunities that we can capitalize on for huge profit.