Waste Management Inc.’s (NYSE: WM) stock has paced an impressive run year-to-date, climbing more than 45% to a 52-week high of $121.77. According to Zacks Equity Research, the broader industrials sector is also on the uptick, churning gains of 25.6% so far in 2019. As the sector grows, a newer player in the market is also catching the attention of seasoned investors.

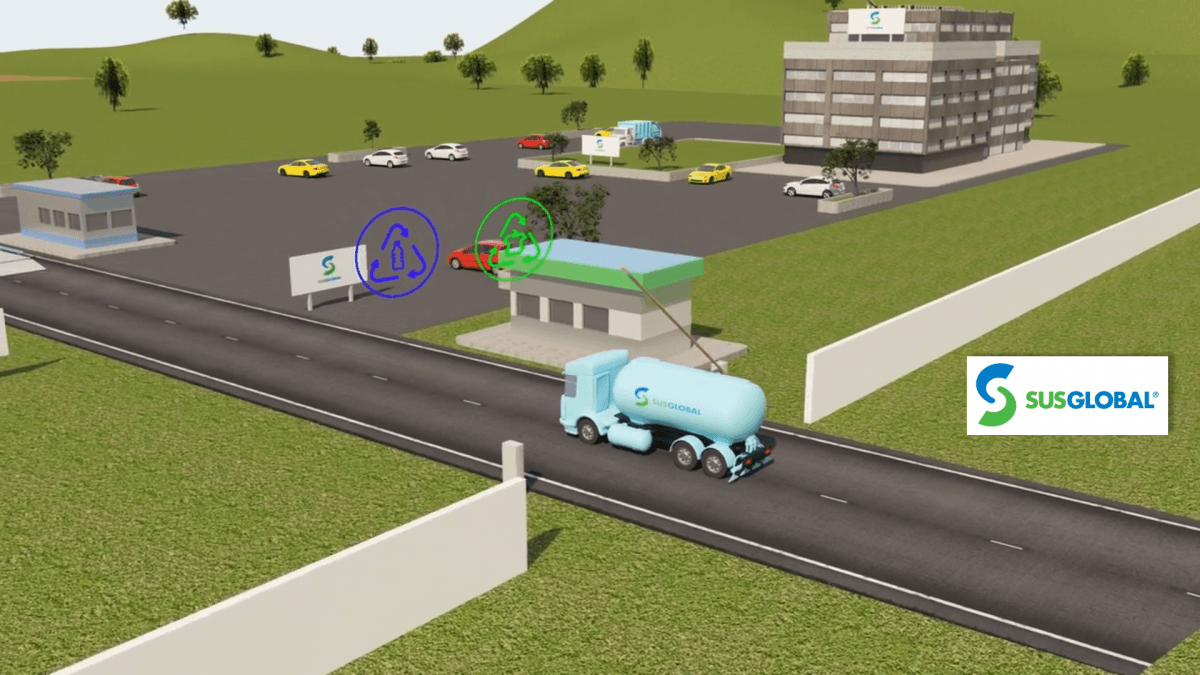

SusGlobal Energy Corp. (OTCQB: SNRG) is a young renewables company focused on acquiring, developing and monetizing a portfolio of proprietary technologies in the global waste-to-energy and regenerative products market. What sets SusGlobal apart from others in the sector is its application of proprietary technology and disruptive processes that provide new-age solutions to the old-world problem of overflowing landfills.

While Waste Management is established in the hauling of waste to landfills, SusGlobal is taking this process a step further. As the human population rises, so does the output of garbage. There’s only so much room on planet earth. Without addressing this core issue, the places to store or dump garbage will reach maximum capacity and landfills will be filled and closed. This, coupled with rising use of technology in collection and recycling processes, will lead to increase in garbage removal prices. As the population grows, it’s clear that services like those offered by SusGlobal will be needed all over the world.

SusGlobal’s full range of services help municipalities properly handle their organic waste. The base of these services is a regenerative approach to an older technology called anerobic digestion. SusGlobal receives source-separated organic streams from a municipality and then processes the waste into an organic slurry that can be piped or trucked to an anaerobic digester. Here, anaerobic digestion breaks down the material and reduces the emission of landfill gas into the atmosphere.

This process also creates a widely used source of renewable energy: a biogas that can fuel combined heat and power gas engines or be upgraded to natural gas-quality biomethane. Additionally, the remaining digestate can be treated with a proprietary heating process and enzymes, and then transformed into a liquid, pathogen-free fertilizer. SusGlobal also makes organic compost from this process, and both the compost and fertilizer have proved successful in the agriculture industry.

This all sounds quite complex, but it is all spelled out in this short video that outlines what the new “Circular Economy” is all about https://vimeo.com/337511486.

As noted above, SusGlobal uses its technology to transform organic waste into nutrient-rich organic compost, diverting organic waste from landfill and reducing Greenhouse Gas (GHG) emissions. It also creates the bed of the company’s product portfolio, which currently includes Earth’s Journey™ Compost and SusGro™ BioFertilizer.

These products provide the company footing in the global liquid fertilizer industry, which is expected to reach nearly $2 billion by 2023. As the popularity of organic farming rises, SusGlobal says it will be able to meet market needs by producing 1,000 liters of liquid fertilizer for every 1 ton of organic waste processed.

Are you seeing the delineating factor here? As opposed to Waste Management, which simply manages waste, SusGlobal is making money from new regenerative products derived from this collected organic waste. The world population shows no signs of slowing, and there is no way to decrease the output of waste. Thanks to companies like SusGlobal, however, there is a way to decrease its impact. Increased demand potentially means increased revenues for service providers. SusGlobal has already proven its technology in Canada and is attracting plenty of attention from a variety of municipalities. All of this translates into revenues.

SusGlobal is young, agile and a revenue-producing company. In Q2 2019, company revenues jumped 67% compared to revenues generated in the same quarter of 2018.

As it currently stands, SusGlobal’s technologies and business model provide the company four distinct revenue streams:

Tipping fee: SusGlobal charges municipalities a fee to divert waste.

Biogas: SusGlobal produces Biogas that can be sent to the pipeline and/or sells electricity to the grid based on the energy produced.

Products: SusGlobal supplies the agriculture industry with pathogen-free organic fertilizer and compost.

Credits: SusGlobal receives carbon credits after municipalities audit to show a reduction in organic waste and diversion from landfill.

Waste Management is an established company with an excellent track record, but currently at a PPS of around $112, it might be too rich an investment for many investors. Take a closer look at SusGlobal and listen to this recent interview with company chairman and President Marc Hazout. You might be surprised at how fast SusGlobal is growing. You might even want to add it to your watchlist today.

About the Author

Stuart Smith is the CEO and Founder of SmallCapVoice.com. SmallCapVoice.com. is a recognized corporate investor relations firm, with clients nationwide, known for its ability to help emerging growth companies build a following among retail and institutional investors. SmallCapVoice.com utilizes its stock newsletter to feature its daily stock picks, audio interviews, as well as its clients’ financial news releases. SmallCapVoice.com also offers individual investors all the tools they need to make informed decisions about the stocks they are interested in. Tools like stock charts, stock alerts, and Company Information Sheets can assist with investing in stocks that are traded on the OTC BB and Pink Sheets. To learn more about SmallCapVoice.com and their services, please visit https://www.smallcapvoice.com/the-small-cap-daily-small-cap-newsletter/